From Static APRs to Live Rates: How BNPL’s AI Changes the Game

Traditional credit cards typically set your annual percentage rate (APR) at the account level, adjusting it only periodically. Even “variable” APRs tied to benchmarks don’t change with each swipe. The CFPB explains that these APRs follow indexes like the Prime Rate and move when issuers update terms—not at the point of sale.

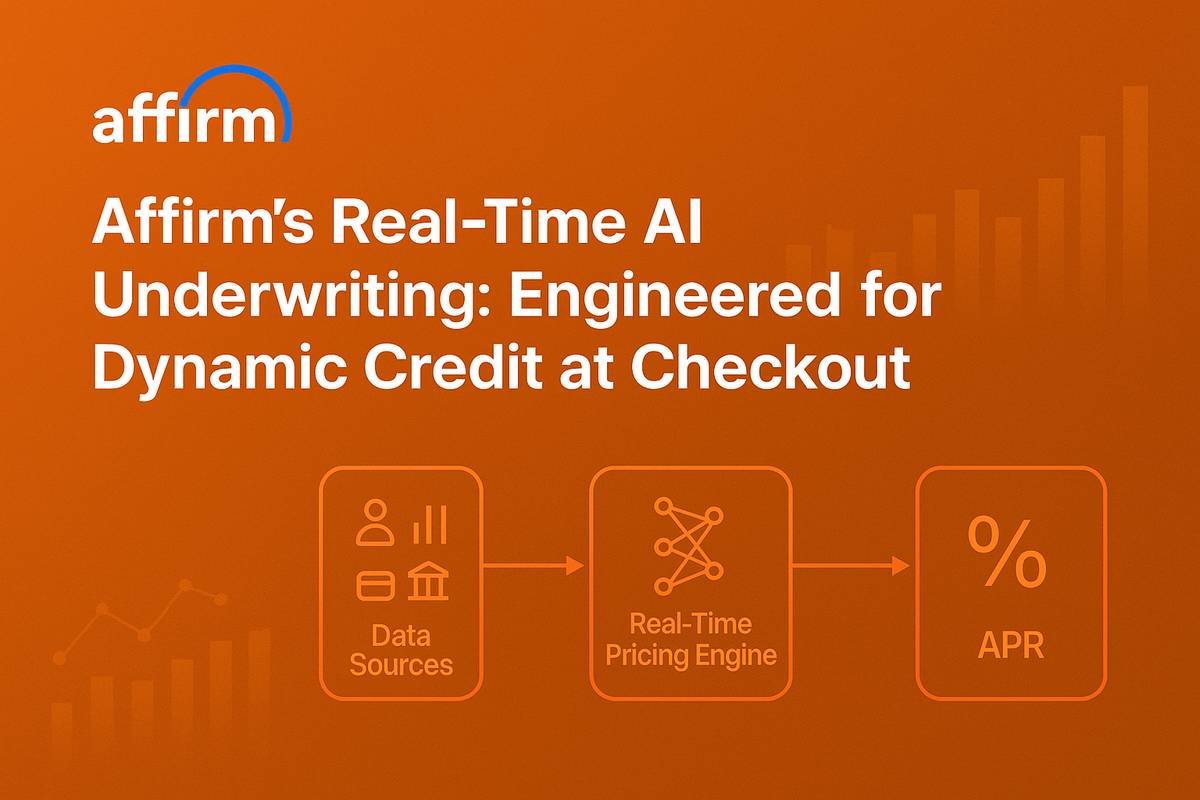

Buy Now, Pay Later (BNPL) models like Affirm break that mold. Instead of one APR for your account, every transaction is freshly underwritten and priced in real time—pulling in current data, adjusting for risk, and factoring in merchant incentives. Max Levchin, Affirm’s CEO, puts it plainly: “We live in a connected real-time world—why wouldn’t we negotiate rates in real time?”

Under the Hood: Affirm’s Engineering for Real-Time Underwriting

Microservices at Scale on AWS

Affirm’s checkout service is built as a microservices architecture on Amazon EKS (Kubernetes). It uses Application Load Balancers, Aurora databases, and AWS STS for secure token operations—designed for 99.99% uptime (just ~52 minutes of downtime per year). This modular design isolates pricing, risk scoring, merchant logic, and transaction processing, enabling rapid deployment and resilience.

Synchronous, Low-Latency Decisions

When you click “Buy,” Affirm’s underwriting runs synchronously, delivering approvals and personalized APRs while you wait. The decision engine executes in sub-second latency, factoring in borrower profile, merchant program rules, and cart details.

Deterministic ML for Fairness and Compliance

Affirm’s underwriting models are deterministic machine learning—not generative AI. This means identical inputs always yield identical outputs, ensuring explainability, reproducibility, and auditability—critical for regulatory compliance in lending.

Continuous Model Training Pipelines

Affirm trains models offline with historical loan data, repayment histories, and credit bureau inputs. Monthly repayment outcomes are labeled for supervised learning, producing probability scores of repayment. Inference happens live at checkout; model retraining cycles continually refine predictions.

Inside the Dynamic Pricing Engine

What Data Does It Need?

Affirm’s real-time pricing draws on a compact but powerful set of signals:

- Credit report data: real-time pulls for scores, utilization, delinquencies, and risk flags.

- Prior Affirm behavior: repayment history, number of prior loans, delinquency patterns.

- Loan parameters: purchase amount, term length, down-payment details.

- Merchant and program data: active promotions, 0% APR subsidies, and merchant discount rates.

- Bank transaction data (via partners like Plaid): most recent income and spending activity for liquidity checks.

How Can It Price So Fast?

Speed comes from engineering efficiency:

- Precomputed features: credit and behavioral metrics are discretized or bucketed for instant lookup.

- Shared online/offline logic: the same code path is used for live underwriting and offline backtesting, eliminating discrepancies and enabling tight optimization.

- Simple interest math: rates are calculated on principal only, reducing computational complexity.

- Deterministic scoring: ensures fast, reproducible results—ideal for caching and audit readiness.

- Merchant rule overrides: promotions can swap in pre-set rates (like 0% APR) without recomputing the entire risk score.

This architecture allows Affirm to return a personalized APR in under a second while the checkout page is still loading.

Consumer Benefits: Tailored, Transparent, and Timely

- Lower-cost financing when it matters: Eligible buyers can receive 0% APR offers on certain carts, funded in part by merchants.

- Flexible payoff schedules: Terms can be extended or shortened per transaction to match affordability and purchasing context.

- Upfront clarity: Each loan is quoted with fixed terms for that purchase—no revolving balances unless you choose them.

Industry Implications: Cards Will Need to Catch Up

This per-transaction, AI-driven pricing pressures traditional credit card issuers to innovate toward more personalized APR promotions and instant credit decisioning. While cards offer variable APRs and temporary promos, BNPL demonstrates how pricing and risk decisions can be embedded at checkout—matching terms to the shopper and purchase in real time.

Guardrails

While real-time underwriting offers flexibility, both providers and consumers must balance convenience with responsibility. Transparent disclosures, affordability assessments, and clear repayment plans are essential to avoid over-borrowing risks.

References

- Affirm Tech Blog — “Highly Resilient Affirm Checkout Architecture”

- Affirm — “Underwriting Approach and Advantage”

- Consumer Financial Protection Bureau — “Fixed vs. Variable APR”

- Affirm Tech Blog — “Exploration for Machine Learning at Affirm”

- Affirm Tech Blog — “Verifying Risk Decisioning Changes”

- Plaid — “Customer Story: Affirm”

- FIS — Partnership with Affirm

- Investors.com — Levchin Interview

- Investopedia — Oppenheimer Analyst Notes

- ProductMint — “How Does Affirm Make Money?”